If you’re an eCommerce business looking to streamline your cross-border shipping operations to the United States, understanding Section 321 is crucial. This provision allows goods valued at $800 or less to enter the U.S. duty and tax-free, making it a game-changer for direct-to-consumer shipments.

In this guide, we’ll dive into what Section 321 is, how it works, its benefits for your business, and how ShipTop can help you get the most out of Section 321 fulfillment.

What is Section 321?

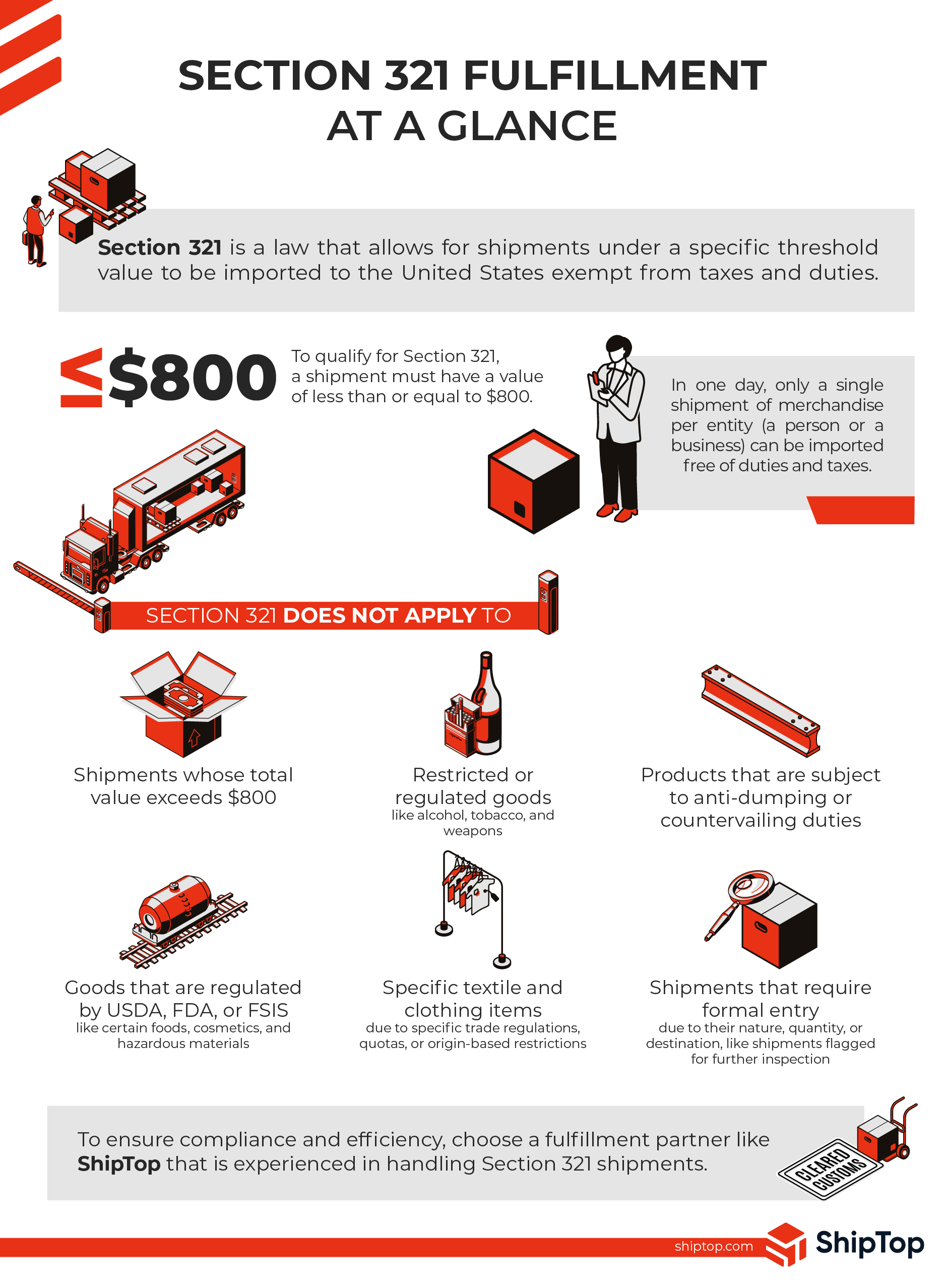

Section 321 is a shipment type that allows goods to clear the U.S. Customs and Border Patrol (CBP), duty-free. Simply put, it’s a law that allows for shipments under a specific threshold value to be imported to the United States exempt from taxes and duties.

To qualify for Section 321 a shipment must have a value of less than or equal to $800 (known as the De Minimis). The CBP raised the De Minimis threshold from $200 to $800 as the result of the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA). For shipments with a higher value, consider DDP shipping.

The De Minimis only allows for one shipment of merchandise by one person (i.e., the business) in one day to be imported free of duties and taxes.

The CBP requires the sender of a shipment to provide vital details like:

- The quantity of goods in the shipment

- The consignee

- The total value

- The origin of the shipment.

As your logistics partner, ShipTop ensures all required information is included on every shipment sent out.

Shipments that do not qualify for Section 321

Section 321 does not apply to:

- Shipments whose total value exceeds $800.

- Restricted or regulated goods. Examples include alcohol, tobacco, weapons and ammunition, and controlled substances (like CBD products with THC).

- Products that are subject to anti-dumping or countervailing duties.

- Goods that are regulated by USDA, FDA, or FSIS. This can include certain food products, cosmetics, hazardous materials, and agricultural products.

- Certain textile and clothing items, due to specific trade regulations, quotas, or origin-based restrictions.

- Shipments that require formal entry due to their nature, quantity, or destination. For example, bonds or shipments containing items flagged for further inspection.

Lastly, let’s also note that combining or breaking shipments — to artificially stay under the $800 threshold — is prohibited. If CBP determines this is happening, the shipment will not qualify.

How to leverage Section 321 to streamline your eCommerce operations

By leveraging this provision, companies can manufacture products abroad at lower costs, and then expedite their shipping process with reduced paperwork and customs requirements.

This approach not only speeds up delivery times but also helps save on international shipping fees, providing more resources to expand and strengthen their presence in the U.S. market.

To ensure compliance and efficiency, choose a fulfillment partner like ShipTop that is experienced in handling Section 321 shipments. Your 3PL must be able to coordinate properly to ensure the submission of all the necessary information before the arrival of the shipment at the border.

Benefits and challenges of Section 321 fulfillment

Here’s a quick overview of the benefits that come with using Section 321:

- Cost savings and efficiency gains: Reducing customs duties, clearance process, and taxes on shipments valued under $800 USD.

- Operational simplicity: Minimizing paperwork and administrative burdens associated with international shipments.

- Market expansion: Facilitating easier entry into the U.S. market, allowing businesses to scale operations effectively.

- Customer satisfaction: Enhancing customer experience with quicker delivery and potentially lower costs.

- Competitive advantage: Gaining a competitive edge by optimizing logistics and operational costs.

That said, be careful of the following limitations of Section 321:

- Value cap: Shipments must not exceed $800 USD in fair retail value to qualify, limiting the types of products that can benefit.

- Restrictions on quantity: While there is no limit on the number of shipments, each individual shipment must meet the de minimis threshold.

- Product restrictions: Certain types of goods may not qualify for Section 321 due to regulatory or customs restrictions.

- Potential delays: Despite faster processing times, unexpected delays can occur during customs clearance, impacting delivery schedules.

- Risk of non-compliance: Failing to meet Section 321 requirements can result in customs delays, penalties, or refusal of entry into the U.S.

How to declare Section 321?

When importing goods valued at $800 or less under Section 321, your shipment can often enter the country duty-free without a formal entry. However, if an eManifest is required, you must inform U.S. Customs and Border Protection (CBP) of your intent to use Section 321.

Here are the steps for declaring Section 321 with an ACE eManifest:

- Select the “Section 321” option: On the Automated Commercial Environment (ACE) manifest, choose the Section 321 option.

- Provide shipment details: Include the number of goods, their value, the shipper, consignee, and country of origin.

- Submit the eManifest: Ensure the eManifest is correctly filed according to the mode of transport (see below).

Mode of transport:

- Truck: The carrier must file the ACE manifest, indicating the goods as intangible/Section 321.

- Ocean: An Importer Security Filing and additional carrier requirements (commonly known as “10+2”) are necessary. Present an arrival notice and invoice in person, and take stamped copies to the Container Freight Station (CFS) warehouses.

- Air: The airline manifest should list the goods as intangible/Section 321.

What are the differences between Section 321 and Section 301?

Section 301 of the Trade Act of 1974 allows the U.S. to impose tariffs and other trade measures to counteract unfair trade practices by other countries, such as intellectual property theft or discriminatory policies.

| Feature | Section 301 | Section 321 |

| Purpose | Imposes tariffs to counter unfair trade practices | Allows duty-free import of goods valued at $800 or less |

| Tariff Rates | 7.5% to 25% on many Chinese imports | No tariffs for eligible shipments |

| Usage Strategy | Seek alternative suppliers, adjust inventory, pass costs to consumers | Break down larger shipments to qualify for duty-free status |

| Affected Products | Wide range of goods from China | Any goods valued at $800 or less |

| Business Impact | Increases cost of goods, requiring supply chain adjustments | Reduces shipping costs by avoiding tariffs |

| Administration | Imposed by U.S. Trade Representative (USTR) | Managed by U.S. Customs and Border Protection (CBP) |

Here’s what ShipTop can do for you

ShipTop offers comprehensive Section 321 fulfillment services that include:

- Streamlined customs compliance: ShipTop ensures that all necessary documentation is accurately prepared and submitted, ensuring smooth and compliant entry of your shipments under Section 321.

- Efficient shipment management: ShipTop’s proprietary platform allows you to manage which shipments will make the Section 321 claim each day. By centralizing this information, you can coordinate with your carriers and fulfillment partners to ensure compliance with the one shipment per day rule.

- Integration with eCommerce fulfillment: We help link your eCommerce fulfillment network, creating clear communication lines with your freight forwarders, customs brokers, and carriers.

- Expert support: ShipTop’s team of experts is always available to provide guidance and support. Whether you need help with complex customs requirements or advice on optimizing your shipping strategy, our knowledgeable professionals are here to assist you.

- Strategically located warehouses: ShipTop offers access to strategically located warehouses in Vancouver and Toronto. This reduces transit times and shipping costs, ensuring that your products reach customers quickly and efficiently.

- Comprehensive reporting and audit trails: ShipTop provides detailed reporting and maintains a clear audit trail for all your shipments. This transparency helps you stay compliant and easily track your shipments, ensuring that you can quickly address any issues that arise.

By partnering with ShipTop, you can navigate the complexities of Section 321 with ease, ensuring that your business benefits from reduced costs and efficient shipping processes.

Get in touch with us to learn more or request a quote to jumpstart the process.